The Foundation of Financial Health

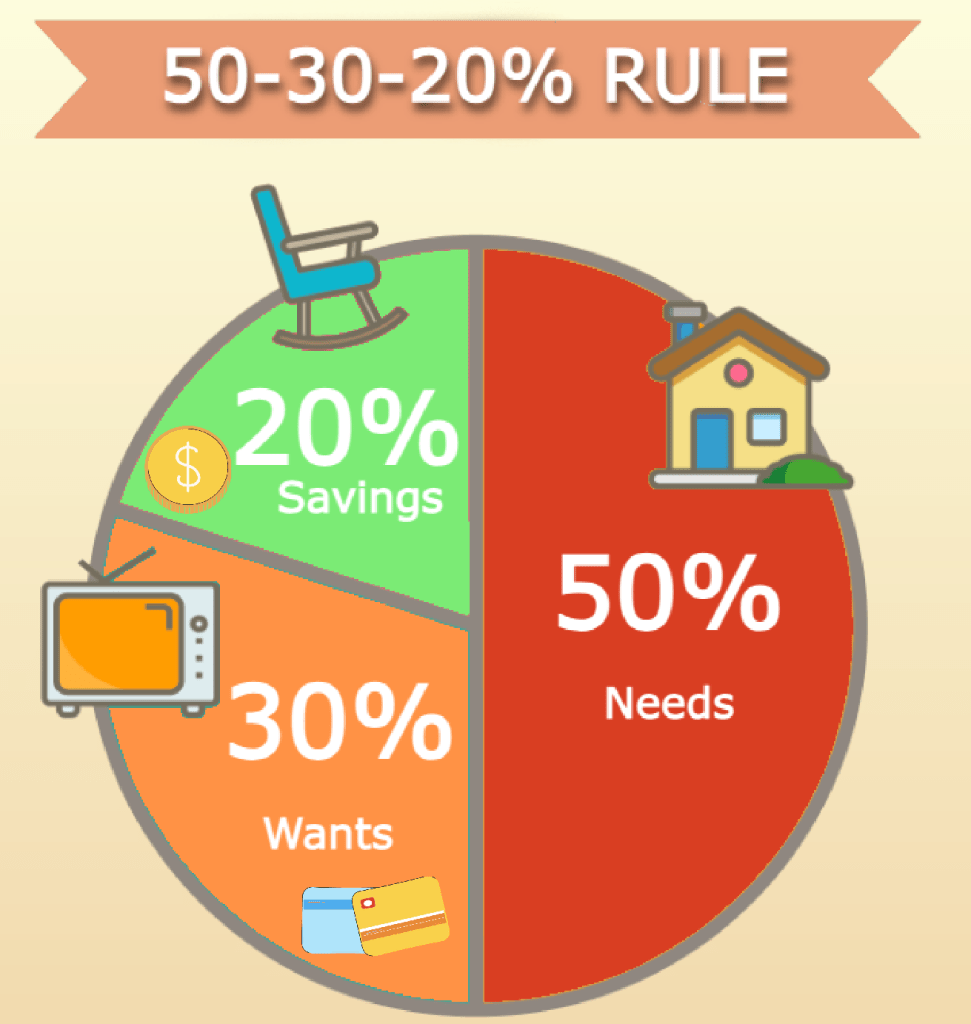

Did you ever wish school had taught you how to budget or save? For many of us, personal finance wasn’t part of our education. So, if you’re feeling uncertain about how to start managing your money, you’re not alone. One simple yet powerful approach to financial management is the 50/30/20 rule, a straightforward guideline that allocates your income into three buckets: needs, wants, and savings.

The goal of this rule is to provide a balanced approach to managing income, ensuring you’re covering essential expenses while saving for the future. Let’s walk through how this rule works and why saving early can make a critical difference in your long-term financial security, retirement planning, and even financial independence.

Breaking Down the 50/30/20 Rule

The 50/30/20 rule is designed to simplify budgeting by dividing your after-tax income into three categories:

- 50% for Needs: These are your essential living expenses—things you can’t live without.

- 30% for Wants: These cover the things that enhance your lifestyle and bring joy, but they’re not necessary for survival.

- 20% for Savings: This portion is for your future, whether that’s an emergency fund, long-term savings, or retirement planning.

This structure is flexible and scalable. Whether you’re just starting in your career or managing a tighter budget, this approach can fit nearly any lifestyle.

50% for Needs

Your “needs” cover fundamental expenses like housing, utilities, groceries, transportation, and insurance. They’re non-negotiable, but you can control how much you spend on them. For instance, consider reducing your grocery bills by meal planning or exploring lower-cost housing options.

Here’s how it might look (based on a $4,000 income):

- Housing (rent or mortgage): $1,200

- Utilities: $150

- Groceries: $300

- Transportation: $200

- Insurance (health or car): $150

Total: $1,800 per month

30% for Wants

The “wants” portion allows you to enjoy life without guilt. This category includes things like dining out, entertainment, subscriptions, hobbies, and travel. While it’s important to enjoy your earnings, remember that overspending here can impact your ability to save for the future. Balance is key.

Examples might include:

- Dining Out: $200

- Streaming Subscriptions: $50

- Hobbies/Classes: $150

- Personal Shopping: $300

- Travel Fund: $500

Total: $1,200 per month

20% for Savings

This category is all about your future self. The 20% dedicated to savings builds an essential safety net for emergencies and helps you reach future goals, whether that’s buying a home, traveling, or securing retirement. When you consistently allocate 20% of your income to savings, you’ll find yourself prepared for both expected and unexpected life events.

Savings allocations could include:

- Emergency Fund: $200

- Long-term Savings (e.g., a high-yield savings account): $300

- Investments : $300

Total: $800 per month

The 20% allocation to savings isn’t just about building wealth. It’s about creating financial independence, security, and peace of mind. Regular contributions, no matter how small, add up over time and can become a substantial fund for your future self.

Real-Life Example Scenarios

Let’s bring this to life with two real-world examples.

Scenario 1: Young Professional on a $3,600 Monthly Income

Consider a young professional earning $3,600 after taxes each month. Here’s how they might apply the 50/30/20 rule:

- Needs (50%): $1,800 allocated to rent, groceries, transportation, and insurance.

- Wants (30%): $1,080 for dining out, personal shopping, and entertainment.

- Savings (20%): $720 set aside for building an emergency fund, contributing to a future travel fund, or starting a retirement account.

Scenario 2: Part-Time Worker on a $2,000 Monthly Income

For someone with a lower income or just starting out, here’s how the rule might adjust:

- Needs (50%): $1,000 for basic expenses (may include roommates or budgeting to keep costs lower).

- Wants (30%): $600 for entertainment, dining out, or hobbies.

- Savings (20%): $400 for an emergency fund or other savings goals.

The flexibility of the 50/30/20 rule makes it adaptable for different income levels. No matter where you are in your financial journey, this structure helps you make room for savings—a key step toward financial independence.

Common Challenges and Solutions

Balancing your budget can come with its challenges. Here are a few common ones and how to tackle them:

- Essential Expenses Exceed 50%: In high-cost living areas, keeping essentials under 50% can be tough. If this is your case, try reallocating slightly, reducing wants, or supplementing income with a side hustle.

- Tracking Spending and Savings: Use budgeting apps like Mint, YNAB, or even a simple spreadsheet to keep track of your allocations each month. Regularly reviewing your budget helps you stay aligned with your goals and adjust as needed.

- Adjusting for Life Changes: Life is dynamic, and so is your budget. With any major change (new job, moving, or significant purchases), re-evaluate your budget to ensure your needs, wants, and savings remain balanced.

Tips for Staying on Track with the 50/30/20 Rule

- Use Apps and Tools: Budgeting apps like Mint, YNAB (You Need A Budget), and PocketGuard can automate your tracking, making it easier to follow your spending and saving habits.

- Monthly Financial Check-Ins: Set a day each month to review your budget, track your progress, and make adjustments if necessary. This habit can keep you motivated and proactive about reaching your goals.

- Accountability with Friends or Family: Share your budgeting goals with a trusted friend or family member who can keep you accountable. You might even encourage each other with money-saving challenges or check-ins.

Why Saving Matters for the Future

Starting to save early—whether it’s for emergencies, big goals, or retirement—builds a habit of preparing for the future. Imagine your savings as a stepping stone to financial independence. Regular saving enables you to make choices based on what’s best for your future self. Whether that’s retiring comfortably, investing in opportunities, or having the freedom to change careers, your savings will open doors.

Financial independence isn’t about reaching a specific dollar amount; it’s about having the flexibility to make life choices without being burdened by financial stress. Start with small steps, trust the process, and watch your financial confidence grow over time.

Conclusion: Start Your Journey to Financial Wellness

The 50/30/20 rule provides a simple roadmap for financial balance, helping you spend wisely, save consistently, and stay mindful of your financial goals. By putting this rule into action, you’re not just budgeting—you’re laying the foundation for a secure future.

Saving and budgeting may not have been part of the school curriculum, but it’s never too late to learn. Start with your next paycheck and see how small changes today can lead to a more empowered tomorrow.

Discover more from Smart Personal Finance

Subscribe to get the latest posts sent to your email.